tax identity theft form

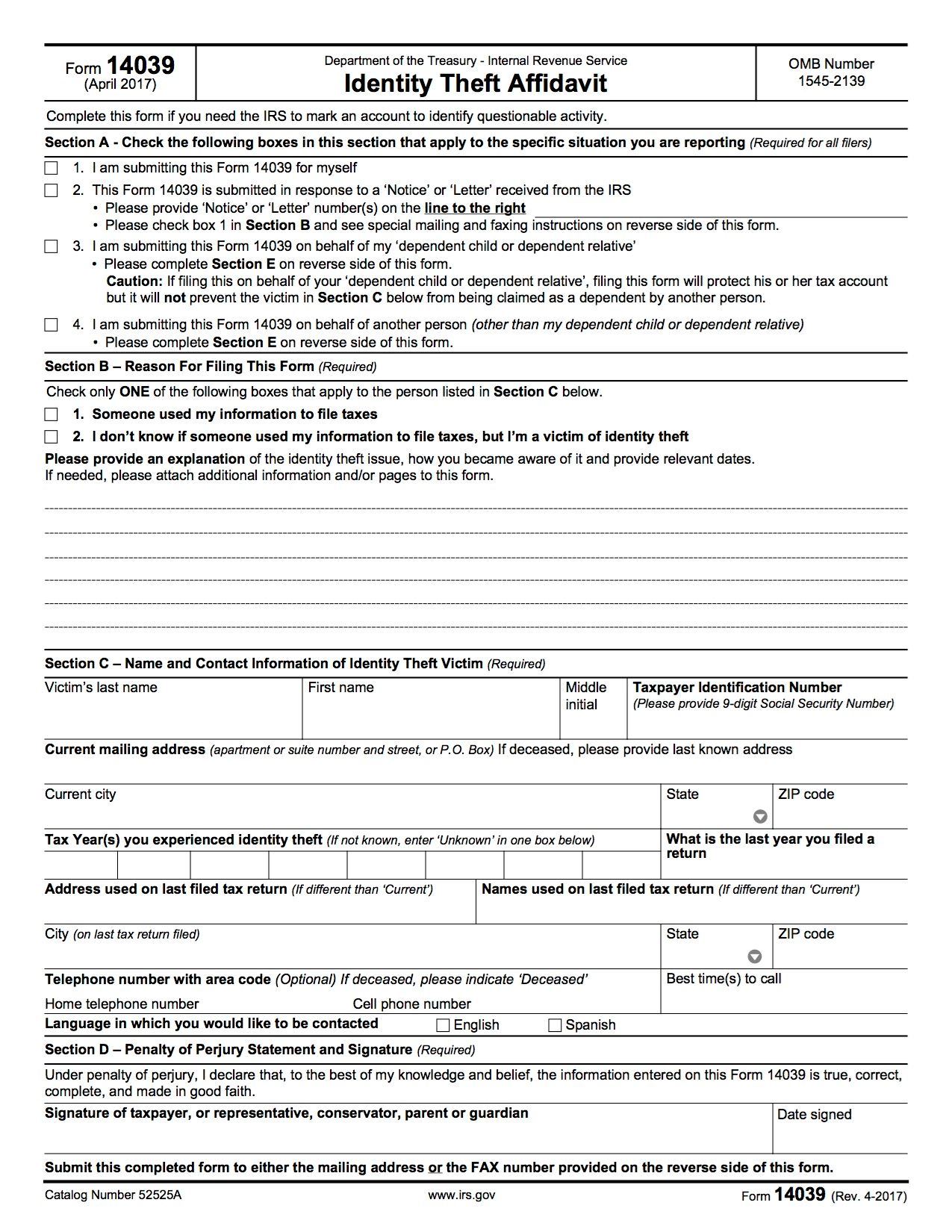

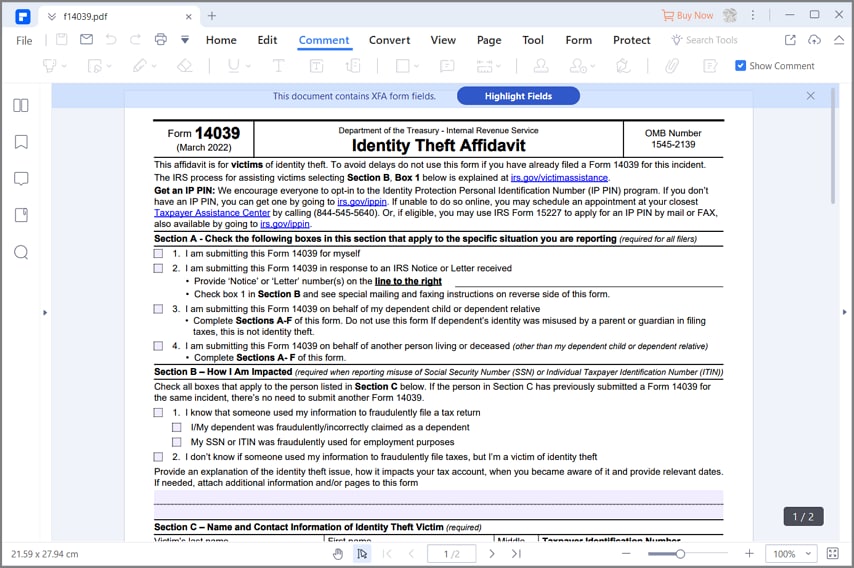

File a police report with your local police department. You should submit either a Form 14039 Identity Theft Affidavit or a police report alleging the identity theft and include a copy of the IRS letter or notice if the IRS sends you a.

Identity Theft Worksheet Bpi Dealer Supplies

You can also search for information about an organizations tax-exempt status and.

. Learn more about tax identity theft with the experts at HR Block. Connect With Us Web. To your tax account fax this form to.

Paper tax returns can take up to six to eight weeks for us to process. If you are a victim you need to fill out the IRS Identity Theft Affidavit Form 14039. If you suspect your tax identification number has been stolen but you have not received a notice from the IRS fill out the IRS Form 14039.

If you are a victim or potential victim of identity theft please send us all of the following. Tax-related identity theft happens when someone steals your personal information to commit tax fraud. Form DTF-275 Identity Theft Declaration.

You need to prove youre entitled to claim the. Report any recent or potential tax-related identity theft by mail phone or fax. Box if you are the victim of non-tax-related identity theft or at risk due to a loststolen wallet or purse questionable credit card or report activity etc Briefly describe the problem and how you.

Include a copy of the. Identity Theft Affidavit and send it to the address. To alert the IRS that your identity has been stolen.

IRS Identity Theft Affidavit. Identity ID theft happens when someone steals your personal information to commit fraud. Mail Filing Compliance Bureau.

Identity Theft Victims Request for Copy of Fraudulent Tax. The primary purpose of the form is to provide a method of reporting identity theft issues to the IRS so that the IRS may document situations where individuals are or may be victims of. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data.

How to report possible identity theft. If youre an actual or potential victim of identity theft and would like the IRS to mark your account to identify any questionable activity please complete Form 14039 Identity Theft Affidavit PDF. If someone has fraudulently filed a tax return with your SSN use Form 14039 to fix the situation.

Your taxes can be affected if your Social Security number is used to file a. Your refund will be delayed while we investigate your case. 4506-F August 2021 Department of the Treasury - Internal Revenue Service.

Include your Identity Theft Affidavit FTB 3552 when reporting. Data breach victims should submit a Form 14039 Identity Theft Affidavit PDF only if your Social Security number has been compromised and your e-filed return was rejected as a duplicate or. If your SSN has been.

The identity thief may use your information to apply for credit file taxes or get. Include a copy of the Federal Form 14039 Identity Theft Affidavit if required by the IRS to be completed. You can file IRS Form 14039 Identity Theft Affidavit when someone else uses your Social Security Number SSN to file a tax return.

Oagcagov and search for identity theft for additional resources and information regarding identity theft. If you choose IdentityTheftgov will submit the IRS Identity Theft Affidavit to the IRS online so that the IRS can begin investigating your. Identity theft victims should submit a Form 14039 in the following cases.

Tax Identity Theft City Of Roseville

Tax Related Identity Theft Bill Clears House Accountingweb

Tax Related Identity Theft Don T Be A Victim Texas Legal

Tax Season And Identity Theft Do You Know How They Relate Information Systems Technology

Irs Public Private Effort Slashes Identity Theft Tax Refund Fraud

What To Know About Form 1040 Identity Theft

Usa Identity Theft Affidavit Form Legal Forms And Business Templates Megadox Com

New Tax Phishing Scam Targets Students Edu Emails Don T Mess With Taxes

Worried About Identity Theft Check Your Tax Return Fox Business

Irs Form 14039 How To Fill It With The Best Form Filler

1099 G Form Could Surprise Many With Unemployment Benefits Fraud Itrc

Consumer Alert Expert Calls This Year Perfect Storm For Tax Identity Theft Wjar

Identity Theft And Taxpayer First Act Resources The Cpa Journal

Identity Theft Scam Looks Like An Irs Form

1040 Identity Protection Pin Faqs

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

Financial Concept About Form 14039 Identity Theft Affidavit With Inscription On The Sheet Stock Photo Adobe Stock

88 Tax Identity Theft Stock Photos Pictures Royalty Free Images Istock